EMI Calculator

Your Amortization Details (Yearly/Monthly)

An EMI Calculator is a powerful tool that helps you calculate your Equated Monthly Installment (EMI) for various loans like home, car, or personal loans. Whether you’re planning to buy a house, finance your dream car, or manage unexpected expenses with a personal loan, knowing your EMI helps you budget effectively and avoid financial stress.

In this comprehensive guide, we will explore how EMI calculators work, their benefits, and step-by-step instructions to calculate EMIs for home, car, and personal loans. We’ll also discuss factors influencing EMI calculations and how to choose the best loans.

अनुक्रम

What is an EMI?

EMI stands for Equated Monthly Installment, which is the fixed monthly amount you pay to repay a loan. It includes two components:

- Principal Amount: The actual loan amount borrowed.

- Interest Amount: The cost of borrowing money, calculated based on the interest rate.

EMIs are spread across the loan tenure, ensuring you pay off your loan in manageable installments.

What is an EMI Calculator?

An EMI Calculator is an online tool designed to compute the monthly EMI for a loan based on:

- Principal Loan Amount

- Interest Rate

- Loan Tenure

It provides instant results, making it easier for borrowers to make informed decisions.

How Does an EMI Calculator Work?

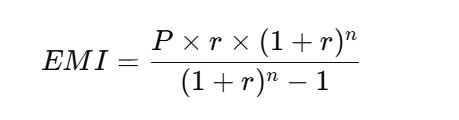

EMI is calculated using the formula:

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual interest rate divided by 12)

- n = Loan tenure in months

For example, if you take a loan of ₹10,00,000 at an annual interest rate of 10% for 10 years (120 months):

- Principal (P) = ₹10,00,000

- Monthly interest rate (r) = 10% ÷ 12 = 0.00833

- Loan tenure (n) = 120 months

Plug these into the formula to calculate your EMI.

Benefits of Using an EMI Calculator

1. Quick and Accurate Results

Avoid manual calculations and human errors. The EMI calculator delivers precise results instantly.

2. Easy Financial Planning

Knowing your EMI helps you allocate your monthly budget effectively.

3. Loan Comparison

Evaluate and compare different loan offers by changing interest rates, tenures, and principal amounts.

4. Time-Saving Tool

With just a few inputs, you can determine the EMI for multiple loans within seconds.

5. Amortization Schedule Insights

Some calculators also provide detailed repayment schedules, showing how much of each payment goes toward principal and interest.

Types of Loans Covered by EMI Calculators

Home Loan EMI Calculator

Buying a home is a significant financial commitment. A home loan EMI calculator can help you assess the affordability of the loan and determine a suitable repayment plan.

Inputs Needed:

- Home loan amount

- Interest rate (fixed or floating)

- Loan tenure (up to 30 years for most home loans)

Example:

For a ₹40,00,000 loan at a 7% annual interest rate over 20 years:

- EMI = ₹31,028 (approximately)

Car Loan EMI Calculator

Car loans are typically for shorter tenures compared to home loans. A car loan EMI calculator helps you estimate monthly payments for financing your dream vehicle.

Inputs Needed:

- Loan amount

- Interest rate (typically 8–12% annually)

- Loan tenure (usually up to 7 years)

Example:

For a ₹6,00,000 car loan at a 10% annual interest rate over 5 years:

- EMI = ₹12,743 (approximately)

Personal Loan EMI Calculator

Personal loans are unsecured loans used for various purposes like medical emergencies, travel, or debt consolidation. The EMI calculator aids in evaluating repayment schedules based on high-interest rates and shorter tenures.

Inputs Needed:

- Loan amount

- Interest rate (typically 12–24% annually)

- Loan tenure (up to 5 years)

Example:

For a ₹2,00,000 personal loan at 15% annual interest over 3 years:

- EMI = ₹6,933 (approximately)

Factors Influencing Your EMI

1. Loan Amount

The higher the principal, the higher the EMI.

2. Interest Rate

A higher interest rate increases your EMI. Opting for a fixed or floating rate also affects calculations.

3. Loan Tenure

Longer tenures reduce the EMI amount but increase the overall interest paid.

4. Type of Loan

Secured loans like home and car loans often have lower interest rates compared to unsecured loans like personal loans.

5. Prepayments

Making partial prepayments can reduce the loan principal and lower your EMI burden.

How to Use an EMI Calculator

Follow these steps to calculate your EMI using an online EMI calculator:

- Enter Loan Amount: Input the principal amount of the loan you want to borrow.

- Specify Interest Rate: Provide the annual interest rate offered by the lender.

- Set Loan Tenure: Input the repayment period in months or years.

- View EMI Results: Instantly see the calculated EMI along with the total interest payable and total loan cost.

- Adjust Inputs: Modify the values to compare different scenarios and find the best fit for your budget.

Top EMI Calculator Features

- User-Friendly Interface: Most tools are designed for simplicity and ease of use.

- Customizable Inputs: Allows users to experiment with different loan terms.

- Graphical Representations: Many calculators offer charts or graphs showing the breakup of principal and interest.

- Mobile Compatibility: Access calculators on-the-go through apps or mobile-friendly websites.

Additional Tools for Better Loan Planning

- Amortization Schedule: A detailed table showing the breakdown of each EMI into principal and interest components over the loan tenure.

- Prepayment Calculator: Estimate how partial prepayments affect your loan tenure or EMI amount.

- Eligibility Calculator: Check how much loan amount you are eligible for based on your income and financial profile.

Tips for Managing EMIs Effectively

- Opt for Affordable EMIs: Ensure your EMI does not exceed 40% of your monthly income to avoid financial strain.

- Choose the Right Tenure: Balance between shorter tenure for lower interest and longer tenure for lower EMIs.

- Keep an Emergency Fund: Maintain a fund to handle unexpected situations, ensuring you don’t default on EMIs.

- Monitor Interest Rates: Keep track of market trends to refinance your loan if lower interest rates become available.

- Automate EMI Payments: Set up auto-debit for timely payments and avoid penalties.

Conclusion

An EMI Calculator is an indispensable tool for anyone planning to take a loan. By simplifying complex calculations, it empowers borrowers to make well-informed decisions. Whether it’s a home, car, or personal loan, knowing your EMI helps you manage your finances effectively and achieve your goals without compromising on financial stability.

Start using an EMI calculator today to find the perfect loan plan and take control of your financial journey!

Frequently Asked Questions (FAQs)

Is an EMI calculator free to use?

Yes, most EMI calculators available online are free and easy to use.

Can I use an EMI calculator for all types of loans?

Absolutely! EMI calculators can be used for home, car, personal, and even education loans.

How accurate are EMI calculators?

EMI calculators are highly accurate, provided you input the correct loan details. However, consult your lender for exact figures.

Can I calculate EMI for a floating interest rate?

Yes, but for floating rates, the EMI may vary over time as the interest rate changes.

Are prepayments accounted for in EMI calculators?

Some advanced calculators allow you to input prepayment details to see their impact on your loan.